The transferee company is incorporated in Malaysia. If the loan amount is RM500000 the stamp duty for the loan agreement is RM500000 x 050 RM2500.

Stamp Duty On Shares Debentures

Under the Stamp Duty Remission No2 Order 2012 Remission Order a taxpayer is.

. Amendments To The Stamps Act 1949. Short title and application. The above amendments came into operation on 1 January 2019.

The Order provides that instruments of service agreements Note that are chargeable under Item 22 1 a First Schedule of the SA will be subject to stamp duty at a rate of 0. Unannotated Statutes of Malaysia - Principal ActsSTAMP ACT 1949 Act 378STAMP ACT 1949 ACT 3782Interpretation. The loan agreement Stamp Duty is 050 from the loan amount.

In this Act unless the context otherwise requires--. Of the amount of the deficient duty. Transfer to the beneficiary to pay RM10 stamp duty or nominal stamp duty under Item 32i of the First Schedule of the Stamp Act 1949 Act 378.

An Act relating to stamp duties. Amendments to the RPGT Act effected in sections 69 69a 69b and 70 of the Finance Act. For other information please click and visit.

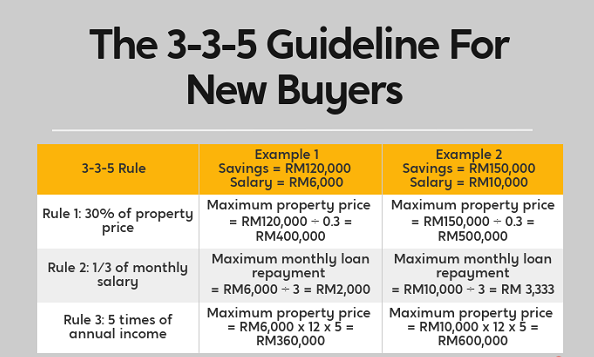

At least two documents will attract stamp duty in a conveyancing transaction. 2 This Act shall apply throughout Malaysia. Just use your physical calculator.

If the instrument is stamped later than 3 months but not later than 6 months after the time for stamping. Service Agreements and Loan Agreements. 1 This Act may be cited as the Stamp Act 1949.

Garis Panduan Permohonan Pelepasan Duti Setem Di Bawah Seksyen 15. Following the above the Stamp Duty Remission Order 2021 PU. Exemption on Micro Financing Scheme List of Financial Institutions.

B 4411989 PART I. 2 This Act shall apply throughout Malaysia. Pursuant to the requirements of the Stamp Act 1949 Stamp Act the Taxpayer paid the Collector of Stamp Duty Collector ad valorem stamp duty on the Facility Agreement amounting to RM 1980000 pursuant to Item 221b of the First Schedule of the Stamp Act.

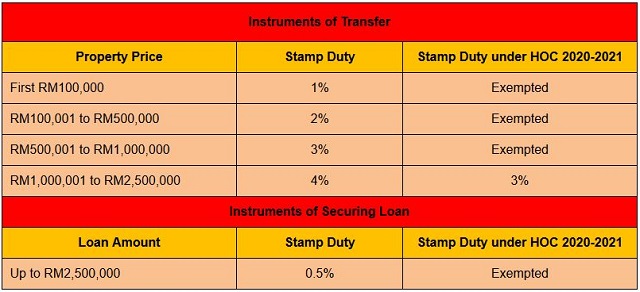

Stamp duty only applies to sales contracts concluded from 1 July 2019 to 31 December 2020 by a legitimate Malaysian citizen. It refers to all stamp duty payable for loan documentation and Memorandum of Transfer to be entitled for 100 exemption. Of the amount of the deficient duty.

In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. Peninsular Malaysia-- 5 December 1949. Year 2016 Stamp Duty Order Remittance PUA 365.

A 428 was gazetted on 25 November 2021 and is deemed to have come into operation on 28 December 2018. Stamp duty relief for transfer of property between associated companies under Section 15A of MSA. In general term stamp duty will be imposed to legal commercial and financial instruments.

Section 15A of the MSA which provides for stamp duty relief for transfer of property between associated companies has been amended to provide for the following conditions. 1 This Act may be cited as the Stamp Act 1949. There are two situations.

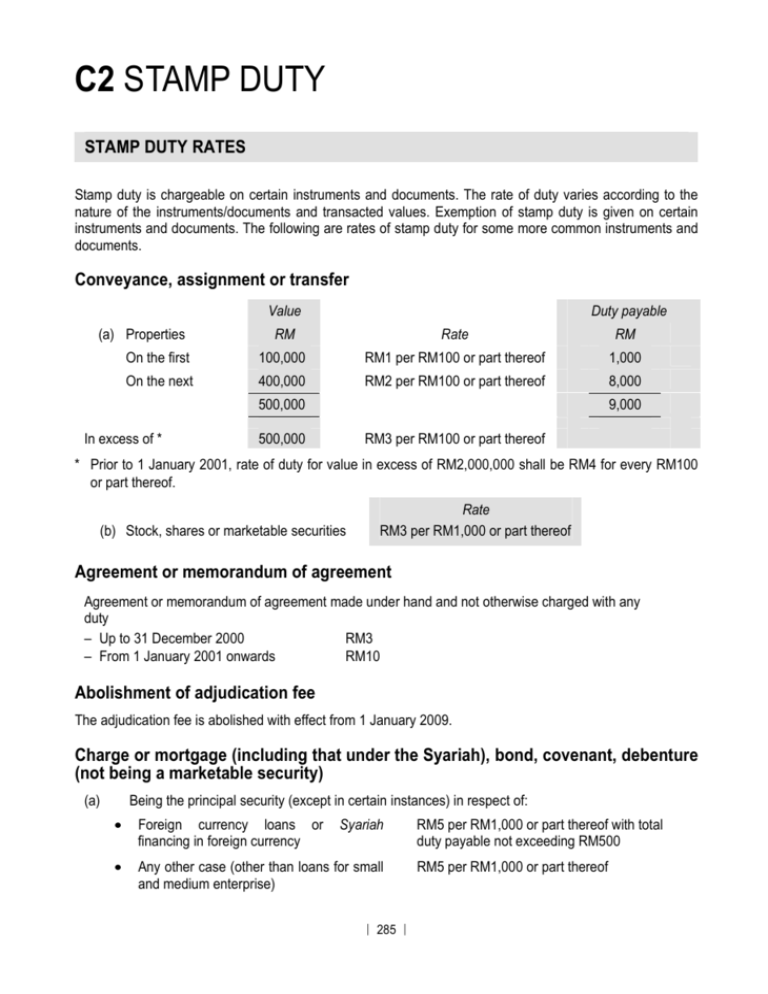

In any other case more than 6 months RM100 or 20. Stamp duty of 05 on the value of the services loans. For the ad valorem duty the amount payable will.

The exemption applies for a maximum loan amount of RM500000. A Stamp duty on instrument of transfer of property Pursuant to section 68d of the Finance Act Item 32A of the First Schedule to the Stamp Act has been amended to read as follows. You dont need a loan stamp duty calculator to calculate this.

Short title and application. Of the amount of the deficient duty. Shares or stock listed on Bursa Malaysia.

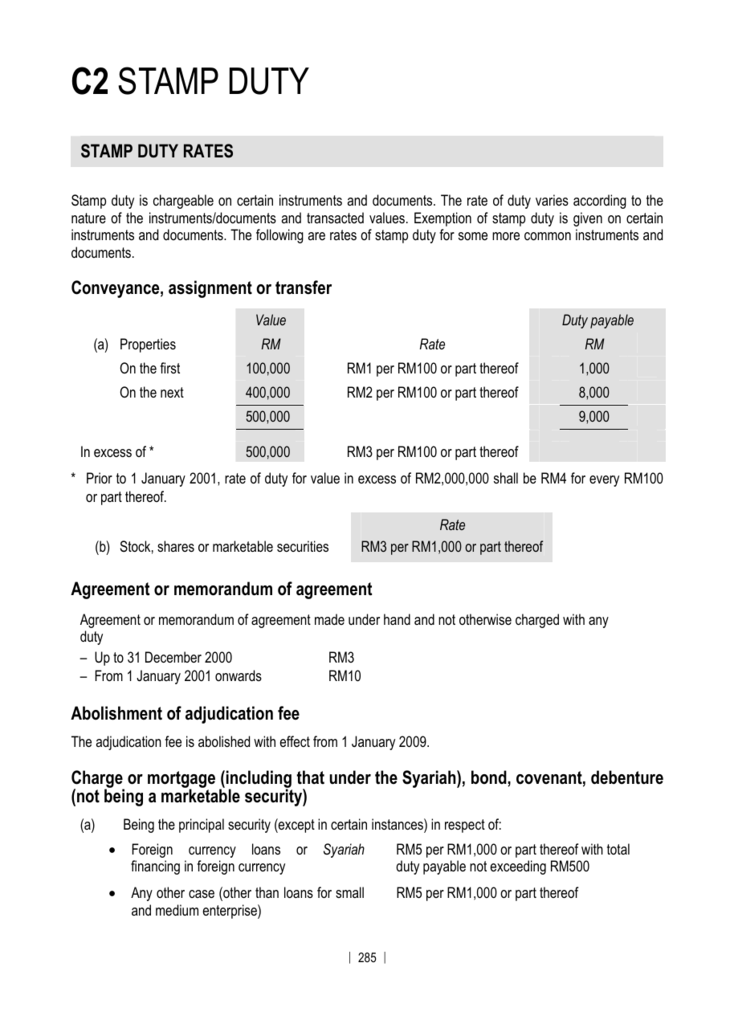

Stamp Duty payable for the transfer by way of Probate. There are two types of Stamp Duty namely ad valorem duty and fixed duty. In Malaysia stamp duty is a tax levied on a large number of written instruments defined in the First Schedule of Stamp Duty Act 1949.

Perjanjian pinjaman berhubung pembelian harta kediaman daripada Perbadanan PR1MA Malaysia. In general stamp duty is applied to legal commercial and financial instruments. Updated guidelines on relief from stamp duty pursuant to Sections 15 and 15A of the Stamp Act 1949 SA The IRB has published on its website updated Guidelines in Bahasa Malaysia on the application for relief from stamp duty under Sections 15 and 15A of the SA as follows.

Sabah and Sarawak-- 1 October 1989 PU. RM1 for every RM1000 or any fraction thereof based on the transaction value increased to RM150 for every RM1000 or fractional part of RM1000 wef. Stamp duty is one of the unavoidable costs in property purchase in Malaysia.

Under the Stamp Act stamp duty is tax payable on the written documents during the sale andor transfer of a real property.

Malaysian Stamp Duty Handbook 6th Edition Marsden Professional Law Book

Stamp St Partners Plt Chartered Accountants Malaysia Facebook

Evidentiary Value Of Unstamped Insufficiently Stamped Docs

Ws Genesis E Stamping Services

C2 Stamp Duty The Malaysian Institute Of Certified Public

Stamp Duty For Transfer Or Assignment Of Intellectual Property Koo Chin Nam Co

Gift Deed Drafting Registration Stamp Duty Tax Implication Faq

C2 Stamp Duty The Malaysian Institute Of Certified Public

1 Nov 2018 Budgeting Inheritance Tax Finance

Ws Genesis E Stamping Services

The Validity Of Unstamped Agreements In Malaysia Fareez Shah And Partners

Stamp Duty And Contracts Yee Partners

Mm Tax Alerts Myanmar Stamp Duty Penalty Reductions Kpmg Myanmar

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate Malaysia